How traditional carriers are turning their fleets green.

May 27, 2025

9 min

read

his article is part three of our four-part sustainability series exploring how modern logistics is evolving to meet environmental challenges.

Why are traditional carriers prioritising sustainability now?

The world’s largest logistics providers are rapidly transforming their operations to meet ambitious environmental goals. What was once seen as optional corporate virtue signalling has evolved into a strategic business imperative with tangible financial implications.

“As demand for sustainable products explodes, climate risks mount, and the potential for regulatory penalties, litigation, and reputational damage increases, the decision to implement enterprise-wide sustainability strategies has become increasingly transactional,” said Sara Gutterman of Green Builder.

After examining broad sustainability strategies across delivery networks in ‘Greening the delivery journey‘ and exploring urban-specific solutions in ‘Smart city logistics for a sustainable future‘, we now focus on how traditional carriers – the established logistics giants who move billions of parcels annually – are implementing practical solutions to reduce their environmental impact.

However, it should be noted early that not everyone is convinced by the industry’s green rhetoric. Chris Sargeant, founder of Fin – Smart Logistics, recently voiced frustration on LinkedIn about the gap between sustainability talk and action: “Every logistics event, every newsletter, every investor deck – full of sustainability noise. Net zero this. Green future that … Meanwhile, out on the ground, companies are sending half-empty vans on routes that don’t make sense.” He argues that before investing in expensive fleet upgrades, companies should focus on the basics: “You can cut your emissions today by running fewer routes. That’s it. No gimmicks.”

Setting ambitious climate targets with concrete action plans.

Traditional carriers have set progressively more ambitious carbon reduction timelines. FedEx is targeting carbon-neutral operations by 2040, while European operators like Evri and Yodel are aiming for 2035. PostNord has set one of the most aggressive timelines, working toward fossil-free transportation by 2030.

These goals are backed by significant investments and detailed roadmaps. FedEx has earmarked over $2bn for GHG reduction initiatives and carbon sequestration research. Its approach follows three principles: “1) Decarbonise what’s possible, 2) Co-create with purpose, and 3) Neutralise what’s left.”

The results are measurable: Yodel has reduced carbon emissions per parcel by 44% since 2016 while increasing parcel volumes by 34%, and PostNord has cut carbon dioxide emissions in transportation and operations by 30% compared to its 2020 baseline.

Fleet innovations making the biggest impact.

While our previous articles have covered urban delivery innovations like cargo bikes and micro-fulfilment centres, traditional carriers face unique challenges in transforming their vast intercity networks and heavy-duty vehicle fleets.

Electric long-haul trucks enter service.

Moving beyond urban areas where electric delivery has gained traction, carriers are now electrifying heavier vehicles. Hived recently announced expansion of “the UK’s only end-to-end electric delivery network”, deploying Mercedes-Benz eActros trucks with 600 kWh battery capacity and 310-mile range. The company is installing megawatt chargers at strategic hubs across the UK to support these vehicles.

This development could revolutionise the ’middle mile’ of parcel delivery – the intercity connections between sorting centres – traditionally one of the most challenging segments to decarbonise due to range and payload requirements.

DPD demonstrates how established carriers can achieve rapid transformation across both light and heavy vehicles. The company has deployed close to 4,000 electric vans while transitioning 95% of its HGV fleet to HVO, achieving an 83% emissions reduction compared to traditional diesel. This dual approach has put DPD on track for a 46% emissions reduction by end of 2024.

According to EVFleetWorld, commercial fleets are leading the EV transition, accounting for “80% of PHEV registrations and 83% of BEV registrations in the first half of 2024” (2024). The report adds: “Looking ahead, collaboration is key… To truly decarbonise, we need more than just technology. We need the industry to work together to overcome barriers, from operational challenges to alternative fuels.”

Second-generation alternative fuels.

Alternative fuels are providing immediate carbon reductions for existing fleets while electric technology matures. Unlike the first-generation biofuels discussed in our previous articles, carriers are now deploying advanced alternatives with higher performance and better sustainability credentials.

PostNord reports that 24% of its transportation fuel now comes from advanced biofuels, primarily hydrogenated vegetable oil (HVO), rapeseed methyl ester (RME) and biogas. These second-generation biofuels avoid many of the land-use and food-competition issues associated with earlier biofuels.

Royal Mail has made significant progress with alternative fuels, deploying over 10 million litres of Hydrotreated Vegetable Oil (HVO) across six key refuelling locations since July 2023. This transition has delivered approximately 30,000 tonnes of CO₂e emissions savings compared to diesel, while Royal Mail ensures all HVO is ISCC certified with Proof of Sustainability certification for full supply chain traceability.

The RAF’s Project ESTER found that HVO serves as “a true drop-in alternative fuel source” for existing vehicles, offering a way to “lessen reliance on global fossil fuel supply chains without detrimental impact on operational output”. This “decarbonisation and operational flexibility advantage” represents a practical approach carriers can adopt with minimal modifications to existing fleets.

European transport company Girteka demonstrates how carriers can integrate these fuels into their customer offerings through its Alternative Fuel Programme. The initiative enables shipping clients to reduce Scope 3 emissions by up to 90% compared to traditional diesel, providing “a reliable and transparent way to reduce emissions, without requiring them to redesign their existing supply chains” (Logistics Business, 2024).

Tackling aviation emissions.

For carriers with air operations, aviation fuel presents the greatest decarbonisation challenge. FedEx’s comprehensive Fuel Sense programme employs over 70 fuel-saving practices, from optimising cruise altitudes to reducing engine use during taxiing. Since 2006, these initiatives have saved 972 million gallons of jet fuel and prevented 9.5 million metric tons of CO₂e.

Beyond operational improvements, carriers are investing in fleet modernisation. FedEx plans to retire its entire MD-11 fleet by 2028, replacing them with more efficient aircraft. Substantial investments in sustainable aviation fuel (SAF) are also underway, with DHL increasing its use to 3.5% despite limited availability – well above the industry average.

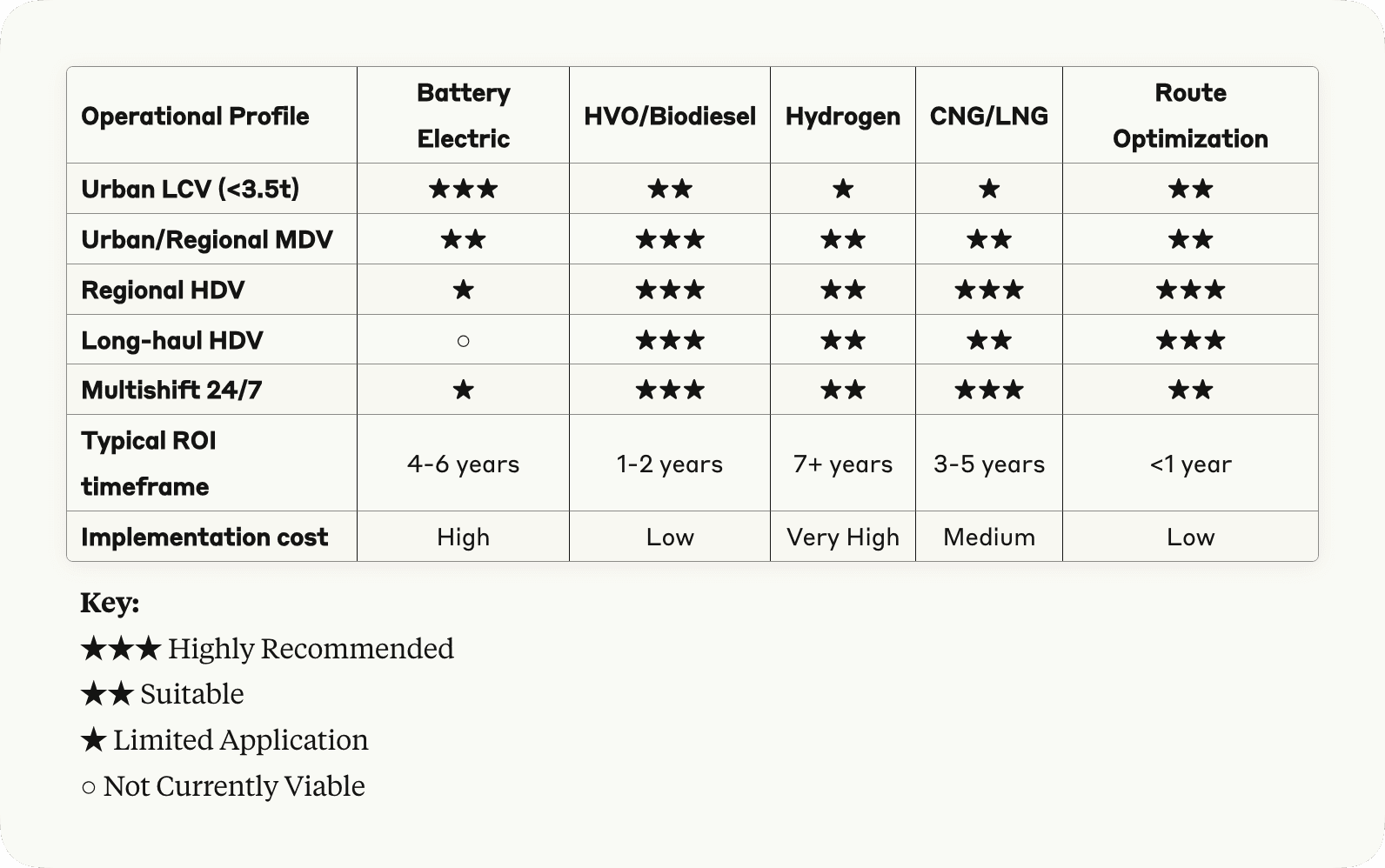

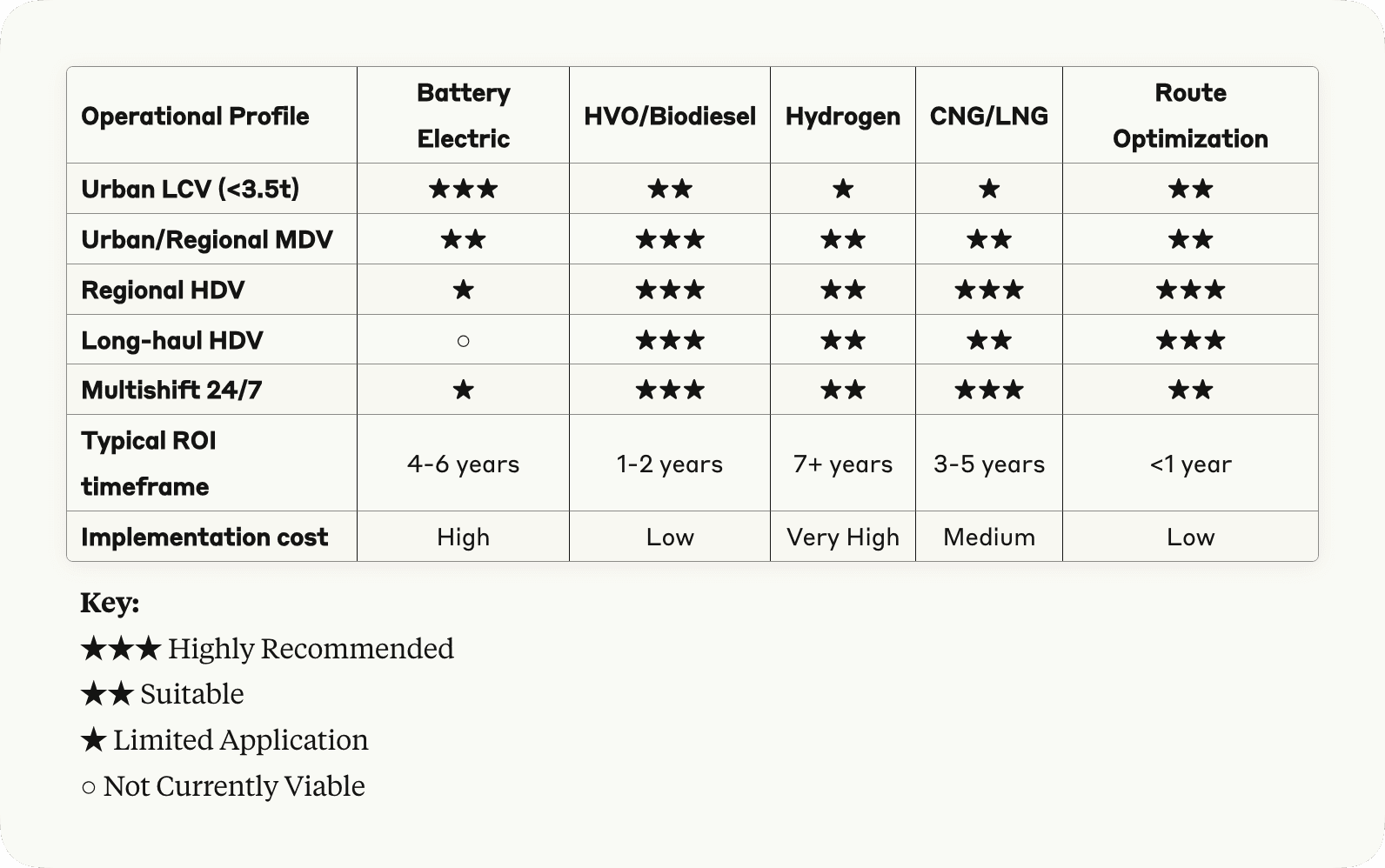

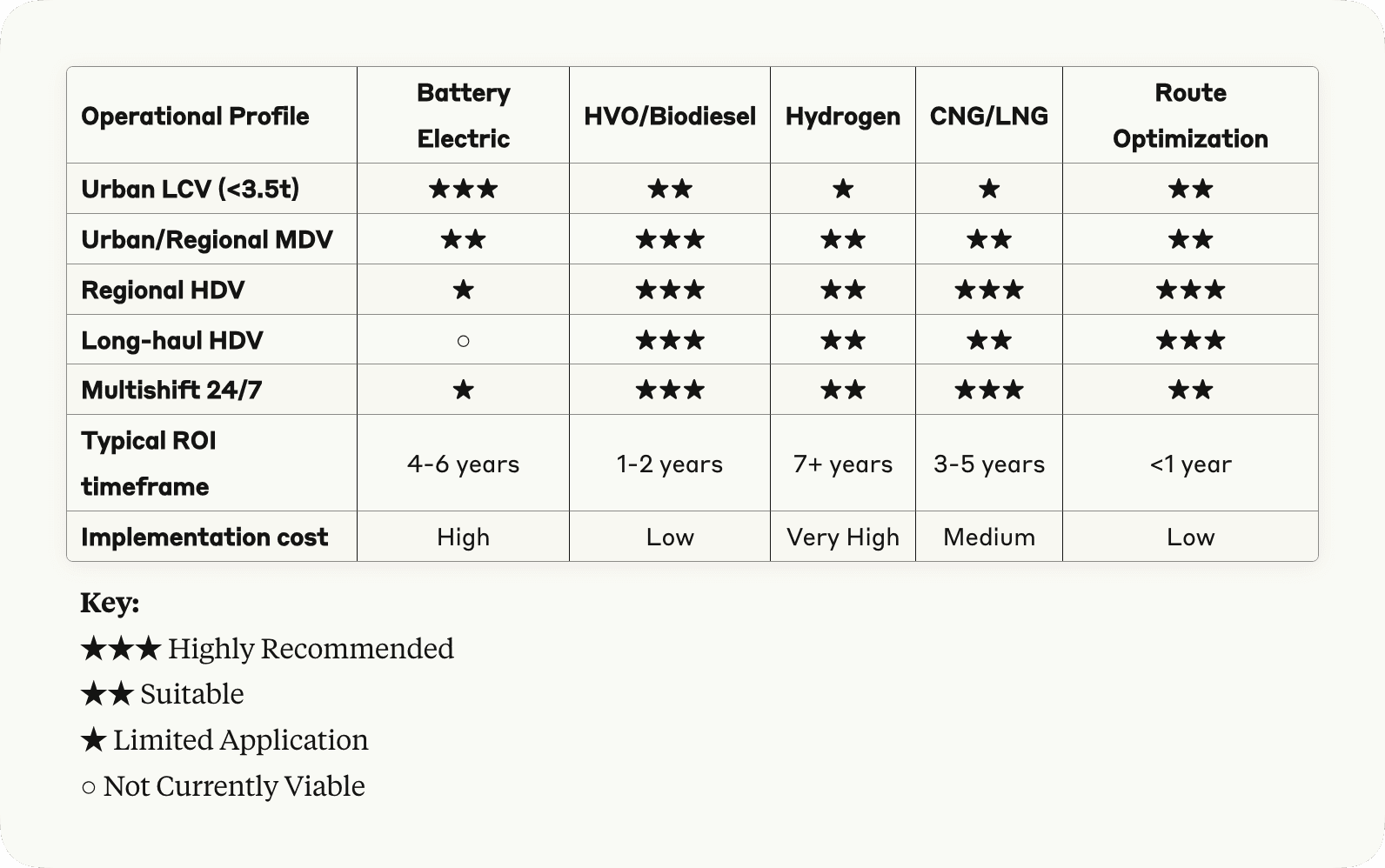

Fleet sustainability technology selection matrix.

Fleet managers face complex decisions when selecting green technologies for their operations. The matrix below offers a practical guide to matching sustainability solutions with specific operational profiles. By considering vehicle types, route characteristics and usage patterns, operators can prioritise investments that deliver the best environmental and financial returns for their particular needs. This at-a-glance reference helps identify which technologies represent “quick wins” versus longer-term transition opportunities across different segments of your fleet operations.

Network efficiency as immediate carbon reduction.

While fleet transformation captures headlines, network optimisation offers immediate emissions reductions without requiring new vehicles.

Intelligent network design.

Traditional carriers are comprehensively reimagining their networks. FedEx’s Network 2.0 initiative aims to improve efficiency across its entire operation, reducing station footprints and optimising linehaul connections. Yodel’s operational reset reduced trunking mileage and cut carbon dioxide emissions by 6% year-over-year without sacrificing delivery capacity.

Royal Mail demonstrates how operational changes can deliver immediate results. The company reduced its total market-based emissions by 8% compared to its 2020-21 baseline despite opening new facilities like the Midlands Parcel Hub and returning to normal activity levels after industrial action.

For supply chain directors, these initiatives represent a crucial shift from treating sustainability as a separate programme to embedding it within core operational efficiency. The strategies that save fuel also reduce costs and often improve service levels.

Next-generation route optimisation.

Beyond the basic routing covered in our previous articles, major carriers are deploying more sophisticated technology. Yodel has equipped its fleet with Microlise technology that goes beyond simple route planning to analyse driver behaviour, traffic patterns and vehicle performance. The company also partnered with what3words to improve delivery accuracy at the address level, reducing failed deliveries and unnecessary repeat journeys.

(Listen to our interview with what3words.)

This focus on operational efficiency echoes Chris Sargeant’s point about immediate carbon reduction through better planning: “Stop pretending a carbon offset makes up for bad planning.” His company claims to have achieved “29% to 42% route reductions” for clients through better planning, suggesting that operational improvements might deliver faster emissions reductions than waiting for fleet electrification.

Strategic facility placement.

Carriers are rethinking the location and function of their sorting facilities to minimise transportation distances. Unlike the urban micro-fulfilment centres covered in our previous article, these are major investments in regional infrastructure.

Yodel’s 162,000 sq ft facility in Huyton represents this approach. Built to Net Zero Carbon standards with solar panels and EV charging infrastructure, the site was strategically positioned to optimise distribution routes across the region. The facility targets a BREEAM Excellent rating and serves as a blueprint for future developments.

Supply chain collaboration amplifying impact.

Recognising that no carrier can transform the industry alone, traditional logistics providers are working with partners to extend their environmental impact.

Supplier engagement programmes.

Major carriers are actively engaging suppliers to reduce Scope 3 emissions. Yodel launched CSR Supplier Awards to recognise environmental excellence in its supply chain, while in 2023 Evri hosted a supplier decarbonisation event bringing together its top 50 strategic suppliers.

FedEx has implemented a comprehensive Supplier Code of Conduct with specific environmental requirements, working with suppliers to identify and mitigate climate-related sourcing risks. This collaborative approach helps address the full emissions footprint of logistics operations, not just the carrier’s direct activities.

Research acceleration.

Rather than relying solely on existing technologies, carriers are investing in research to develop next-generation sustainability solutions. FedEx committed $100m to help establish the Yale Center for Natural Carbon Capture, which researches techniques for long-term carbon removal.

Major carriers also participate in initiatives like the First Movers Coalition to accelerate development of sustainable aviation fuels and other clean technologies. These collaborations help create market demand for emerging solutions, accelerating their commercial viability.

The road ahead for sustainable delivery.

As traditional carriers continue transforming their operations, several emerging trends point to the future of sustainable logistics:

Cross-carrier collaboration models are breaking down competitive barriers. SAP highlights “load pooling” where “similar (even competitive) companies work together to pool their warehouse and logistics resources” using “cloud-connected logistics management technologies”. This approach reduces empty miles and improves vehicle utilisation across the industry.

Advanced predictive logistics will further enhance efficiency. Beyond simple route optimisation, AI and machine learning systems can predict delivery patterns days or weeks in advance, allowing carriers to plan vehicle deployment and energy usage with unprecedented precision.

Carbon measurement standardisation is improving accountability. As carriers adopt consistent methodologies for calculating and reporting emissions, customers can make more meaningful comparisons between providers, driving further competitive innovation in sustainability.

The transformation of traditional carriers toward more sustainable operations represents one of the most significant shifts in logistics industry history. What’s particularly encouraging is how these initiatives increasingly align with business objectives like operational efficiency, cost reduction and customer satisfaction.

In the words of Green Builder, companies executing comprehensive sustainability strategies are “enjoying the benefits of amplified competitiveness, reduced risks and decreased costs”. The journey to fully sustainable delivery continues, with challenges remaining in long-haul transportation and air freight. However, the progress made by traditional carriers demonstrates that substantial emissions reductions are achievable even as parcel volumes grow.

As we’ll explore in our final article, these environmental improvements do come with financial considerations. But perhaps the most prudent approach combines immediate operational efficiencies – like Chris Sargeant’s focus on eliminating unnecessary routes – with longer-term investments in greener vehicles and fuels. After all, the greenest mile is the one that doesn’t need to be driven at all.

Share article.

News & Updates

Get specially curated goodness delivered straight to your inbox.

his article is part three of our four-part sustainability series exploring how modern logistics is evolving to meet environmental challenges.

Why are traditional carriers prioritising sustainability now?

The world’s largest logistics providers are rapidly transforming their operations to meet ambitious environmental goals. What was once seen as optional corporate virtue signalling has evolved into a strategic business imperative with tangible financial implications.

“As demand for sustainable products explodes, climate risks mount, and the potential for regulatory penalties, litigation, and reputational damage increases, the decision to implement enterprise-wide sustainability strategies has become increasingly transactional,” said Sara Gutterman of Green Builder.

After examining broad sustainability strategies across delivery networks in ‘Greening the delivery journey‘ and exploring urban-specific solutions in ‘Smart city logistics for a sustainable future‘, we now focus on how traditional carriers – the established logistics giants who move billions of parcels annually – are implementing practical solutions to reduce their environmental impact.

However, it should be noted early that not everyone is convinced by the industry’s green rhetoric. Chris Sargeant, founder of Fin – Smart Logistics, recently voiced frustration on LinkedIn about the gap between sustainability talk and action: “Every logistics event, every newsletter, every investor deck – full of sustainability noise. Net zero this. Green future that … Meanwhile, out on the ground, companies are sending half-empty vans on routes that don’t make sense.” He argues that before investing in expensive fleet upgrades, companies should focus on the basics: “You can cut your emissions today by running fewer routes. That’s it. No gimmicks.”

Setting ambitious climate targets with concrete action plans.

Traditional carriers have set progressively more ambitious carbon reduction timelines. FedEx is targeting carbon-neutral operations by 2040, while European operators like Evri and Yodel are aiming for 2035. PostNord has set one of the most aggressive timelines, working toward fossil-free transportation by 2030.

These goals are backed by significant investments and detailed roadmaps. FedEx has earmarked over $2bn for GHG reduction initiatives and carbon sequestration research. Its approach follows three principles: “1) Decarbonise what’s possible, 2) Co-create with purpose, and 3) Neutralise what’s left.”

The results are measurable: Yodel has reduced carbon emissions per parcel by 44% since 2016 while increasing parcel volumes by 34%, and PostNord has cut carbon dioxide emissions in transportation and operations by 30% compared to its 2020 baseline.

Fleet innovations making the biggest impact.

While our previous articles have covered urban delivery innovations like cargo bikes and micro-fulfilment centres, traditional carriers face unique challenges in transforming their vast intercity networks and heavy-duty vehicle fleets.

Electric long-haul trucks enter service.

Moving beyond urban areas where electric delivery has gained traction, carriers are now electrifying heavier vehicles. Hived recently announced expansion of “the UK’s only end-to-end electric delivery network”, deploying Mercedes-Benz eActros trucks with 600 kWh battery capacity and 310-mile range. The company is installing megawatt chargers at strategic hubs across the UK to support these vehicles.

This development could revolutionise the ’middle mile’ of parcel delivery – the intercity connections between sorting centres – traditionally one of the most challenging segments to decarbonise due to range and payload requirements.

DPD demonstrates how established carriers can achieve rapid transformation across both light and heavy vehicles. The company has deployed close to 4,000 electric vans while transitioning 95% of its HGV fleet to HVO, achieving an 83% emissions reduction compared to traditional diesel. This dual approach has put DPD on track for a 46% emissions reduction by end of 2024.

According to EVFleetWorld, commercial fleets are leading the EV transition, accounting for “80% of PHEV registrations and 83% of BEV registrations in the first half of 2024” (2024). The report adds: “Looking ahead, collaboration is key… To truly decarbonise, we need more than just technology. We need the industry to work together to overcome barriers, from operational challenges to alternative fuels.”

Second-generation alternative fuels.

Alternative fuels are providing immediate carbon reductions for existing fleets while electric technology matures. Unlike the first-generation biofuels discussed in our previous articles, carriers are now deploying advanced alternatives with higher performance and better sustainability credentials.

PostNord reports that 24% of its transportation fuel now comes from advanced biofuels, primarily hydrogenated vegetable oil (HVO), rapeseed methyl ester (RME) and biogas. These second-generation biofuels avoid many of the land-use and food-competition issues associated with earlier biofuels.

Royal Mail has made significant progress with alternative fuels, deploying over 10 million litres of Hydrotreated Vegetable Oil (HVO) across six key refuelling locations since July 2023. This transition has delivered approximately 30,000 tonnes of CO₂e emissions savings compared to diesel, while Royal Mail ensures all HVO is ISCC certified with Proof of Sustainability certification for full supply chain traceability.

The RAF’s Project ESTER found that HVO serves as “a true drop-in alternative fuel source” for existing vehicles, offering a way to “lessen reliance on global fossil fuel supply chains without detrimental impact on operational output”. This “decarbonisation and operational flexibility advantage” represents a practical approach carriers can adopt with minimal modifications to existing fleets.

European transport company Girteka demonstrates how carriers can integrate these fuels into their customer offerings through its Alternative Fuel Programme. The initiative enables shipping clients to reduce Scope 3 emissions by up to 90% compared to traditional diesel, providing “a reliable and transparent way to reduce emissions, without requiring them to redesign their existing supply chains” (Logistics Business, 2024).

Tackling aviation emissions.

For carriers with air operations, aviation fuel presents the greatest decarbonisation challenge. FedEx’s comprehensive Fuel Sense programme employs over 70 fuel-saving practices, from optimising cruise altitudes to reducing engine use during taxiing. Since 2006, these initiatives have saved 972 million gallons of jet fuel and prevented 9.5 million metric tons of CO₂e.

Beyond operational improvements, carriers are investing in fleet modernisation. FedEx plans to retire its entire MD-11 fleet by 2028, replacing them with more efficient aircraft. Substantial investments in sustainable aviation fuel (SAF) are also underway, with DHL increasing its use to 3.5% despite limited availability – well above the industry average.

Fleet sustainability technology selection matrix.

Fleet managers face complex decisions when selecting green technologies for their operations. The matrix below offers a practical guide to matching sustainability solutions with specific operational profiles. By considering vehicle types, route characteristics and usage patterns, operators can prioritise investments that deliver the best environmental and financial returns for their particular needs. This at-a-glance reference helps identify which technologies represent “quick wins” versus longer-term transition opportunities across different segments of your fleet operations.

Network efficiency as immediate carbon reduction.

While fleet transformation captures headlines, network optimisation offers immediate emissions reductions without requiring new vehicles.

Intelligent network design.

Traditional carriers are comprehensively reimagining their networks. FedEx’s Network 2.0 initiative aims to improve efficiency across its entire operation, reducing station footprints and optimising linehaul connections. Yodel’s operational reset reduced trunking mileage and cut carbon dioxide emissions by 6% year-over-year without sacrificing delivery capacity.

Royal Mail demonstrates how operational changes can deliver immediate results. The company reduced its total market-based emissions by 8% compared to its 2020-21 baseline despite opening new facilities like the Midlands Parcel Hub and returning to normal activity levels after industrial action.

For supply chain directors, these initiatives represent a crucial shift from treating sustainability as a separate programme to embedding it within core operational efficiency. The strategies that save fuel also reduce costs and often improve service levels.

Next-generation route optimisation.

Beyond the basic routing covered in our previous articles, major carriers are deploying more sophisticated technology. Yodel has equipped its fleet with Microlise technology that goes beyond simple route planning to analyse driver behaviour, traffic patterns and vehicle performance. The company also partnered with what3words to improve delivery accuracy at the address level, reducing failed deliveries and unnecessary repeat journeys.

(Listen to our interview with what3words.)

This focus on operational efficiency echoes Chris Sargeant’s point about immediate carbon reduction through better planning: “Stop pretending a carbon offset makes up for bad planning.” His company claims to have achieved “29% to 42% route reductions” for clients through better planning, suggesting that operational improvements might deliver faster emissions reductions than waiting for fleet electrification.

Strategic facility placement.

Carriers are rethinking the location and function of their sorting facilities to minimise transportation distances. Unlike the urban micro-fulfilment centres covered in our previous article, these are major investments in regional infrastructure.

Yodel’s 162,000 sq ft facility in Huyton represents this approach. Built to Net Zero Carbon standards with solar panels and EV charging infrastructure, the site was strategically positioned to optimise distribution routes across the region. The facility targets a BREEAM Excellent rating and serves as a blueprint for future developments.

Supply chain collaboration amplifying impact.

Recognising that no carrier can transform the industry alone, traditional logistics providers are working with partners to extend their environmental impact.

Supplier engagement programmes.

Major carriers are actively engaging suppliers to reduce Scope 3 emissions. Yodel launched CSR Supplier Awards to recognise environmental excellence in its supply chain, while in 2023 Evri hosted a supplier decarbonisation event bringing together its top 50 strategic suppliers.

FedEx has implemented a comprehensive Supplier Code of Conduct with specific environmental requirements, working with suppliers to identify and mitigate climate-related sourcing risks. This collaborative approach helps address the full emissions footprint of logistics operations, not just the carrier’s direct activities.

Research acceleration.

Rather than relying solely on existing technologies, carriers are investing in research to develop next-generation sustainability solutions. FedEx committed $100m to help establish the Yale Center for Natural Carbon Capture, which researches techniques for long-term carbon removal.

Major carriers also participate in initiatives like the First Movers Coalition to accelerate development of sustainable aviation fuels and other clean technologies. These collaborations help create market demand for emerging solutions, accelerating their commercial viability.

The road ahead for sustainable delivery.

As traditional carriers continue transforming their operations, several emerging trends point to the future of sustainable logistics:

Cross-carrier collaboration models are breaking down competitive barriers. SAP highlights “load pooling” where “similar (even competitive) companies work together to pool their warehouse and logistics resources” using “cloud-connected logistics management technologies”. This approach reduces empty miles and improves vehicle utilisation across the industry.

Advanced predictive logistics will further enhance efficiency. Beyond simple route optimisation, AI and machine learning systems can predict delivery patterns days or weeks in advance, allowing carriers to plan vehicle deployment and energy usage with unprecedented precision.

Carbon measurement standardisation is improving accountability. As carriers adopt consistent methodologies for calculating and reporting emissions, customers can make more meaningful comparisons between providers, driving further competitive innovation in sustainability.

The transformation of traditional carriers toward more sustainable operations represents one of the most significant shifts in logistics industry history. What’s particularly encouraging is how these initiatives increasingly align with business objectives like operational efficiency, cost reduction and customer satisfaction.

In the words of Green Builder, companies executing comprehensive sustainability strategies are “enjoying the benefits of amplified competitiveness, reduced risks and decreased costs”. The journey to fully sustainable delivery continues, with challenges remaining in long-haul transportation and air freight. However, the progress made by traditional carriers demonstrates that substantial emissions reductions are achievable even as parcel volumes grow.

As we’ll explore in our final article, these environmental improvements do come with financial considerations. But perhaps the most prudent approach combines immediate operational efficiencies – like Chris Sargeant’s focus on eliminating unnecessary routes – with longer-term investments in greener vehicles and fuels. After all, the greenest mile is the one that doesn’t need to be driven at all.

Share article.

News & Updates

Get specially curated goodness delivered straight to your inbox.

his article is part three of our four-part sustainability series exploring how modern logistics is evolving to meet environmental challenges.

Why are traditional carriers prioritising sustainability now?

The world’s largest logistics providers are rapidly transforming their operations to meet ambitious environmental goals. What was once seen as optional corporate virtue signalling has evolved into a strategic business imperative with tangible financial implications.

“As demand for sustainable products explodes, climate risks mount, and the potential for regulatory penalties, litigation, and reputational damage increases, the decision to implement enterprise-wide sustainability strategies has become increasingly transactional,” said Sara Gutterman of Green Builder.

After examining broad sustainability strategies across delivery networks in ‘Greening the delivery journey‘ and exploring urban-specific solutions in ‘Smart city logistics for a sustainable future‘, we now focus on how traditional carriers – the established logistics giants who move billions of parcels annually – are implementing practical solutions to reduce their environmental impact.

However, it should be noted early that not everyone is convinced by the industry’s green rhetoric. Chris Sargeant, founder of Fin – Smart Logistics, recently voiced frustration on LinkedIn about the gap between sustainability talk and action: “Every logistics event, every newsletter, every investor deck – full of sustainability noise. Net zero this. Green future that … Meanwhile, out on the ground, companies are sending half-empty vans on routes that don’t make sense.” He argues that before investing in expensive fleet upgrades, companies should focus on the basics: “You can cut your emissions today by running fewer routes. That’s it. No gimmicks.”

Setting ambitious climate targets with concrete action plans.

Traditional carriers have set progressively more ambitious carbon reduction timelines. FedEx is targeting carbon-neutral operations by 2040, while European operators like Evri and Yodel are aiming for 2035. PostNord has set one of the most aggressive timelines, working toward fossil-free transportation by 2030.

These goals are backed by significant investments and detailed roadmaps. FedEx has earmarked over $2bn for GHG reduction initiatives and carbon sequestration research. Its approach follows three principles: “1) Decarbonise what’s possible, 2) Co-create with purpose, and 3) Neutralise what’s left.”

The results are measurable: Yodel has reduced carbon emissions per parcel by 44% since 2016 while increasing parcel volumes by 34%, and PostNord has cut carbon dioxide emissions in transportation and operations by 30% compared to its 2020 baseline.

Fleet innovations making the biggest impact.

While our previous articles have covered urban delivery innovations like cargo bikes and micro-fulfilment centres, traditional carriers face unique challenges in transforming their vast intercity networks and heavy-duty vehicle fleets.

Electric long-haul trucks enter service.

Moving beyond urban areas where electric delivery has gained traction, carriers are now electrifying heavier vehicles. Hived recently announced expansion of “the UK’s only end-to-end electric delivery network”, deploying Mercedes-Benz eActros trucks with 600 kWh battery capacity and 310-mile range. The company is installing megawatt chargers at strategic hubs across the UK to support these vehicles.

This development could revolutionise the ’middle mile’ of parcel delivery – the intercity connections between sorting centres – traditionally one of the most challenging segments to decarbonise due to range and payload requirements.

DPD demonstrates how established carriers can achieve rapid transformation across both light and heavy vehicles. The company has deployed close to 4,000 electric vans while transitioning 95% of its HGV fleet to HVO, achieving an 83% emissions reduction compared to traditional diesel. This dual approach has put DPD on track for a 46% emissions reduction by end of 2024.

According to EVFleetWorld, commercial fleets are leading the EV transition, accounting for “80% of PHEV registrations and 83% of BEV registrations in the first half of 2024” (2024). The report adds: “Looking ahead, collaboration is key… To truly decarbonise, we need more than just technology. We need the industry to work together to overcome barriers, from operational challenges to alternative fuels.”

Second-generation alternative fuels.

Alternative fuels are providing immediate carbon reductions for existing fleets while electric technology matures. Unlike the first-generation biofuels discussed in our previous articles, carriers are now deploying advanced alternatives with higher performance and better sustainability credentials.

PostNord reports that 24% of its transportation fuel now comes from advanced biofuels, primarily hydrogenated vegetable oil (HVO), rapeseed methyl ester (RME) and biogas. These second-generation biofuels avoid many of the land-use and food-competition issues associated with earlier biofuels.

Royal Mail has made significant progress with alternative fuels, deploying over 10 million litres of Hydrotreated Vegetable Oil (HVO) across six key refuelling locations since July 2023. This transition has delivered approximately 30,000 tonnes of CO₂e emissions savings compared to diesel, while Royal Mail ensures all HVO is ISCC certified with Proof of Sustainability certification for full supply chain traceability.

The RAF’s Project ESTER found that HVO serves as “a true drop-in alternative fuel source” for existing vehicles, offering a way to “lessen reliance on global fossil fuel supply chains without detrimental impact on operational output”. This “decarbonisation and operational flexibility advantage” represents a practical approach carriers can adopt with minimal modifications to existing fleets.

European transport company Girteka demonstrates how carriers can integrate these fuels into their customer offerings through its Alternative Fuel Programme. The initiative enables shipping clients to reduce Scope 3 emissions by up to 90% compared to traditional diesel, providing “a reliable and transparent way to reduce emissions, without requiring them to redesign their existing supply chains” (Logistics Business, 2024).

Tackling aviation emissions.

For carriers with air operations, aviation fuel presents the greatest decarbonisation challenge. FedEx’s comprehensive Fuel Sense programme employs over 70 fuel-saving practices, from optimising cruise altitudes to reducing engine use during taxiing. Since 2006, these initiatives have saved 972 million gallons of jet fuel and prevented 9.5 million metric tons of CO₂e.

Beyond operational improvements, carriers are investing in fleet modernisation. FedEx plans to retire its entire MD-11 fleet by 2028, replacing them with more efficient aircraft. Substantial investments in sustainable aviation fuel (SAF) are also underway, with DHL increasing its use to 3.5% despite limited availability – well above the industry average.

Fleet sustainability technology selection matrix.

Fleet managers face complex decisions when selecting green technologies for their operations. The matrix below offers a practical guide to matching sustainability solutions with specific operational profiles. By considering vehicle types, route characteristics and usage patterns, operators can prioritise investments that deliver the best environmental and financial returns for their particular needs. This at-a-glance reference helps identify which technologies represent “quick wins” versus longer-term transition opportunities across different segments of your fleet operations.

Network efficiency as immediate carbon reduction.

While fleet transformation captures headlines, network optimisation offers immediate emissions reductions without requiring new vehicles.

Intelligent network design.

Traditional carriers are comprehensively reimagining their networks. FedEx’s Network 2.0 initiative aims to improve efficiency across its entire operation, reducing station footprints and optimising linehaul connections. Yodel’s operational reset reduced trunking mileage and cut carbon dioxide emissions by 6% year-over-year without sacrificing delivery capacity.

Royal Mail demonstrates how operational changes can deliver immediate results. The company reduced its total market-based emissions by 8% compared to its 2020-21 baseline despite opening new facilities like the Midlands Parcel Hub and returning to normal activity levels after industrial action.

For supply chain directors, these initiatives represent a crucial shift from treating sustainability as a separate programme to embedding it within core operational efficiency. The strategies that save fuel also reduce costs and often improve service levels.

Next-generation route optimisation.

Beyond the basic routing covered in our previous articles, major carriers are deploying more sophisticated technology. Yodel has equipped its fleet with Microlise technology that goes beyond simple route planning to analyse driver behaviour, traffic patterns and vehicle performance. The company also partnered with what3words to improve delivery accuracy at the address level, reducing failed deliveries and unnecessary repeat journeys.

(Listen to our interview with what3words.)

This focus on operational efficiency echoes Chris Sargeant’s point about immediate carbon reduction through better planning: “Stop pretending a carbon offset makes up for bad planning.” His company claims to have achieved “29% to 42% route reductions” for clients through better planning, suggesting that operational improvements might deliver faster emissions reductions than waiting for fleet electrification.

Strategic facility placement.

Carriers are rethinking the location and function of their sorting facilities to minimise transportation distances. Unlike the urban micro-fulfilment centres covered in our previous article, these are major investments in regional infrastructure.

Yodel’s 162,000 sq ft facility in Huyton represents this approach. Built to Net Zero Carbon standards with solar panels and EV charging infrastructure, the site was strategically positioned to optimise distribution routes across the region. The facility targets a BREEAM Excellent rating and serves as a blueprint for future developments.

Supply chain collaboration amplifying impact.

Recognising that no carrier can transform the industry alone, traditional logistics providers are working with partners to extend their environmental impact.

Supplier engagement programmes.

Major carriers are actively engaging suppliers to reduce Scope 3 emissions. Yodel launched CSR Supplier Awards to recognise environmental excellence in its supply chain, while in 2023 Evri hosted a supplier decarbonisation event bringing together its top 50 strategic suppliers.

FedEx has implemented a comprehensive Supplier Code of Conduct with specific environmental requirements, working with suppliers to identify and mitigate climate-related sourcing risks. This collaborative approach helps address the full emissions footprint of logistics operations, not just the carrier’s direct activities.

Research acceleration.

Rather than relying solely on existing technologies, carriers are investing in research to develop next-generation sustainability solutions. FedEx committed $100m to help establish the Yale Center for Natural Carbon Capture, which researches techniques for long-term carbon removal.

Major carriers also participate in initiatives like the First Movers Coalition to accelerate development of sustainable aviation fuels and other clean technologies. These collaborations help create market demand for emerging solutions, accelerating their commercial viability.

The road ahead for sustainable delivery.

As traditional carriers continue transforming their operations, several emerging trends point to the future of sustainable logistics:

Cross-carrier collaboration models are breaking down competitive barriers. SAP highlights “load pooling” where “similar (even competitive) companies work together to pool their warehouse and logistics resources” using “cloud-connected logistics management technologies”. This approach reduces empty miles and improves vehicle utilisation across the industry.

Advanced predictive logistics will further enhance efficiency. Beyond simple route optimisation, AI and machine learning systems can predict delivery patterns days or weeks in advance, allowing carriers to plan vehicle deployment and energy usage with unprecedented precision.

Carbon measurement standardisation is improving accountability. As carriers adopt consistent methodologies for calculating and reporting emissions, customers can make more meaningful comparisons between providers, driving further competitive innovation in sustainability.

The transformation of traditional carriers toward more sustainable operations represents one of the most significant shifts in logistics industry history. What’s particularly encouraging is how these initiatives increasingly align with business objectives like operational efficiency, cost reduction and customer satisfaction.

In the words of Green Builder, companies executing comprehensive sustainability strategies are “enjoying the benefits of amplified competitiveness, reduced risks and decreased costs”. The journey to fully sustainable delivery continues, with challenges remaining in long-haul transportation and air freight. However, the progress made by traditional carriers demonstrates that substantial emissions reductions are achievable even as parcel volumes grow.

As we’ll explore in our final article, these environmental improvements do come with financial considerations. But perhaps the most prudent approach combines immediate operational efficiencies – like Chris Sargeant’s focus on eliminating unnecessary routes – with longer-term investments in greener vehicles and fuels. After all, the greenest mile is the one that doesn’t need to be driven at all.

Share article.

News & Updates

Get specially curated goodness delivered straight to your inbox.